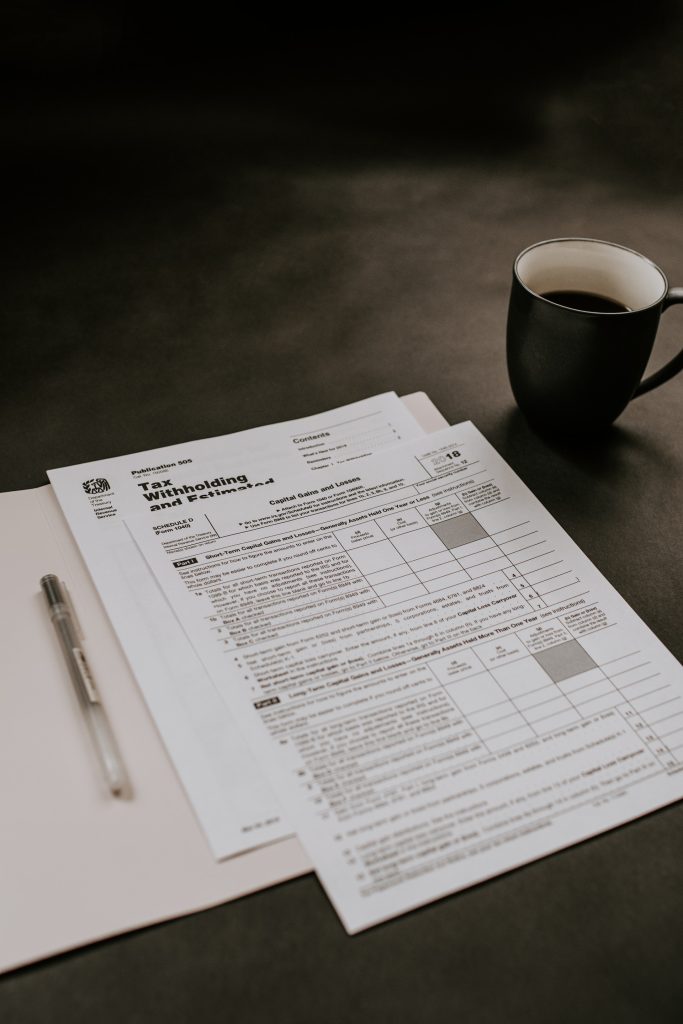

Taxes can be a daunting topic for many of us. But the truth is, they’re a crucial part of our financial lives, and ignoring them can lead to serious consequences. So let’s dive in and demystify taxes!

First off, let’s talk about the W-2 earners. If you’re a salaried employee or paid hourly, you need to make sure you’re paying at least 12.5% of your gross check to the government. Yep, that’s right. Before any deductions, including medical, vision, and retirement, you should be setting aside a portion of your income to cover your tax bill.

But what if you’re a high-income earner? In that case, you should be aiming to set aside at least 25% of your income to cover your taxes.

Now, what about the self-employed and contractors? If that’s you, things get a bit more complicated. Since you’re not having taxes withheld from your paycheck, you need to be proactive and take matters into your own hands. A good rule of thumb is to set aside at least 35% of your gross income and place it in hands-off account known as your “tax account.” Alternatively, you can hire a professional to help you with estimated quarterly tax payments and avoid getting hit with a huge bill at the end of the year.

The bottom line is that taxes are essential to our financial well-being, and we shouldn’t be afraid to discuss them. By understanding the basics of taxes, we can make informed decisions and avoid unpleasant surprises down the road. So don’t be shy, let’s talk about taxes!

Until next time, stay focused.

Bree

Growth Strategist